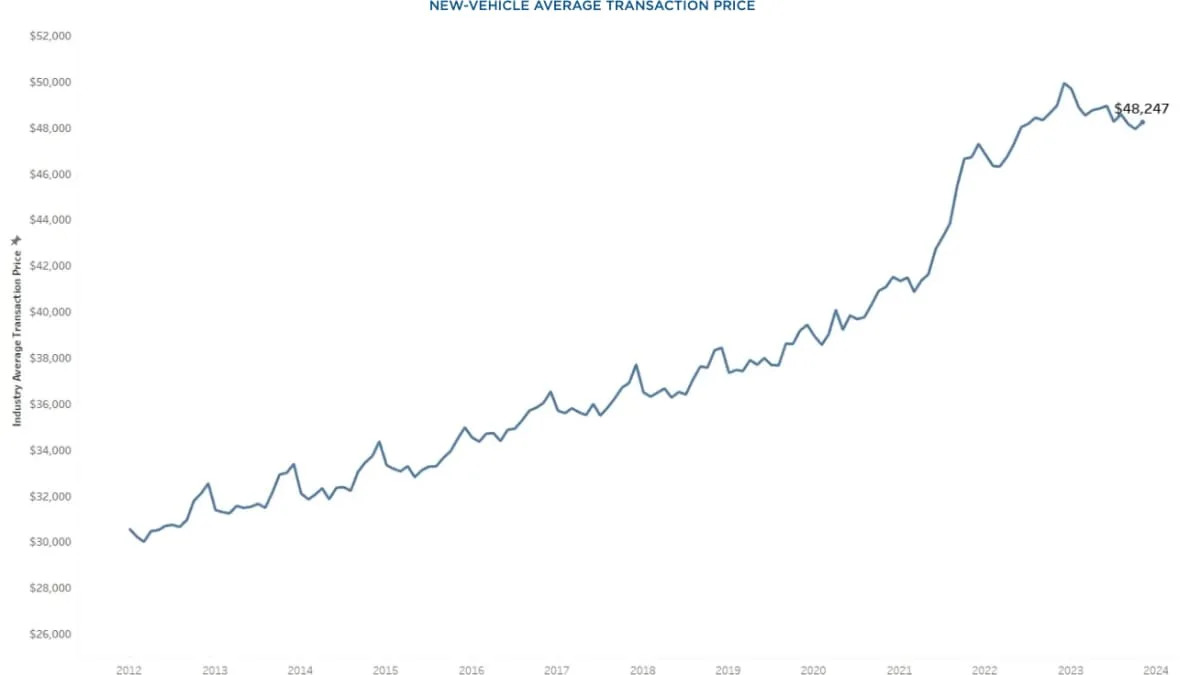

Indicating a extra constructive pattern for shoppers, information launched this week by Kelley Blue Guide present that November marked the third consecutive month through which new-vehicle common transaction costs have been decrease yr over yr. KBB stated that the previous three months mark the one time previously decade that the month-to-month new-vehicle common costs didn’t improve year-over-year.

In truth, the common worth for a brand new car in November was as much as $48,247, however that determine displays a rise of lower than 1 p.c on a month-over-month foundation, in keeping with information launched from KBB.

For electrical autos, the costs rose barely in November to $52,345, up from a revised $51,715 in October. Then again, EV incentives reached their highest level of 2023 at 8.9 p.c of the common worth; a yr in the past, EV incentives have been lower than 2 p.c of ATP.

“In recent months, price parity between EVs and ICE has almost seemed possible,” added Stephanie Valdez-Streaty, director of Strategic Planning at Cox Automotive. “It is a complicated measure with plenty of variables, but newer products and higher discounts have brought down average EV prices, even before potential tax incentives. A year ago, the EV premium was more than 30 percent. Today, it’s less than 10 percent.”

The across-the-board software of discounting and incentives and rebates diminished the common producer’s instructed retail worth (MSRP) on autos to 98.3 p.c in November, the bottom degree since April 2021. That stated, the common MSRPs elevated practically 1 p.c from a yr in the past.

After retreating barely in October, incentives elevated additional in November, reaching a brand new excessive for 2023 of 5.2 p.c of the transaction worth, and climbing above 5 p.c of ATP for the primary time in additional than two years. Solely a yr in the past, the common incentive bundle was 2.2 p.c.

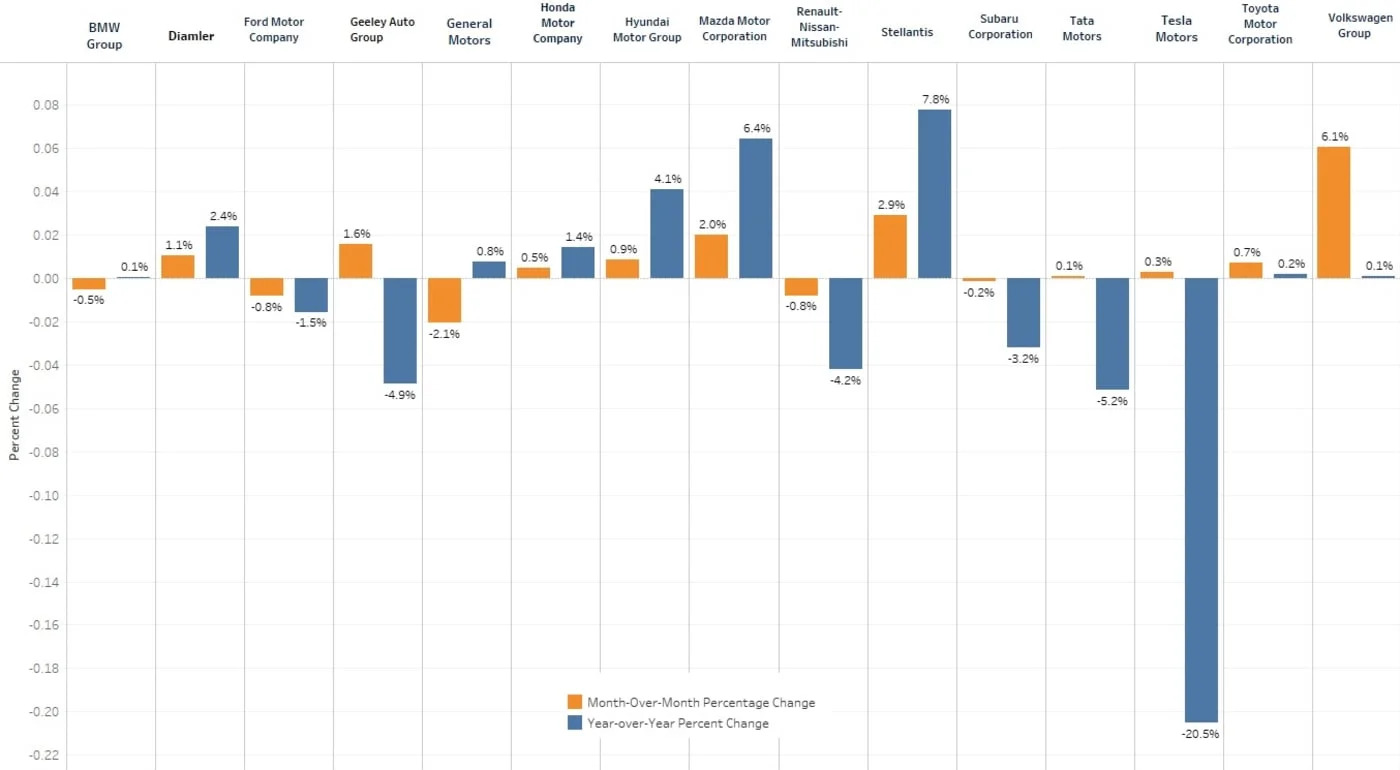

Of the 35 manufacturers that KBB included in its November evaluation, 16 had year-over-year worth declines in November, with the most important declines recorded for Tesla (-20.5 p.c), Buick (-6.4), Land Rover (-6.0) and Nissan (-5.7). The most important year-over-year transaction-price will increase got here from Dodge (+11.2 p.c), Ram (+10.5), Audi (+7.8) and GMC (+7.8).

The scorching luxurious market final month posted an 8.4 p.c year-over-year improve in gross sales, with gross sales leaping 19.6 p.c yr over yr. In truth, luxurious share of the U.S. market was above 20 p.c for the primary time on file, in keeping with the Kelley Blue Guide information.

Chalk up elevated gross sales in that section to a lower within the common worth of seven.5 p.c yr over yr, thanks partially to a rise in stock. The common worth paid for a luxurious car in November was $63,235.

Luxurious model incentives averaged 5.8 p.c of ATP in November, up from 4.6 p.c in October and 5.4 p.c in September. Tesla, Buick, Land Rover, Volvo and Acura had the most important ATP declines final month amongst luxurious manufacturers within the Kelley Blue Guide database.