Yearly we hear a variety of buzz about youngsters not studying “real” cash abilities in class, like find out how to do taxes, for example. Submitting taxes is one thing each pupil will navigate sooner or later. And whereas most excessive faculties do a tremendous job making ready youngsters for faculty and careers, it’s powerful to slot in time to study taxes.

Fortunately, we’ve discovered a FREE, ready-to-go resolution to study taxes.

Our associates at EVERFI have teamed up with Intuit, the worldwide know-how platform that makes TurboTax, QuickBooks, Credit score Karma, and Mailchimp, to create the primary hands-on tax simulation for highschool college students. Intuit not too long ago launched Intuit for Schooling, a free monetary literacy platform for school rooms. Embedded inside EVERFI’s Excessive Faculty Monetary Literacy Course, the Intuit TurboTax Simulation is related, accessible, and interesting. And better of all, the curriculum is completely free.

You don’t have to be a tax skilled your self to make use of the Intuit TurboTax Simulation.

Let’s face it, taxes may be complicated, even for adults! However the Intuit TurboTax Simulation comes with a pack of instructor sources that will help you deal with the matters coated and reply pupil questions—no in depth prep work required.

Younger folks be taught by placing themselves in others’ footwear.

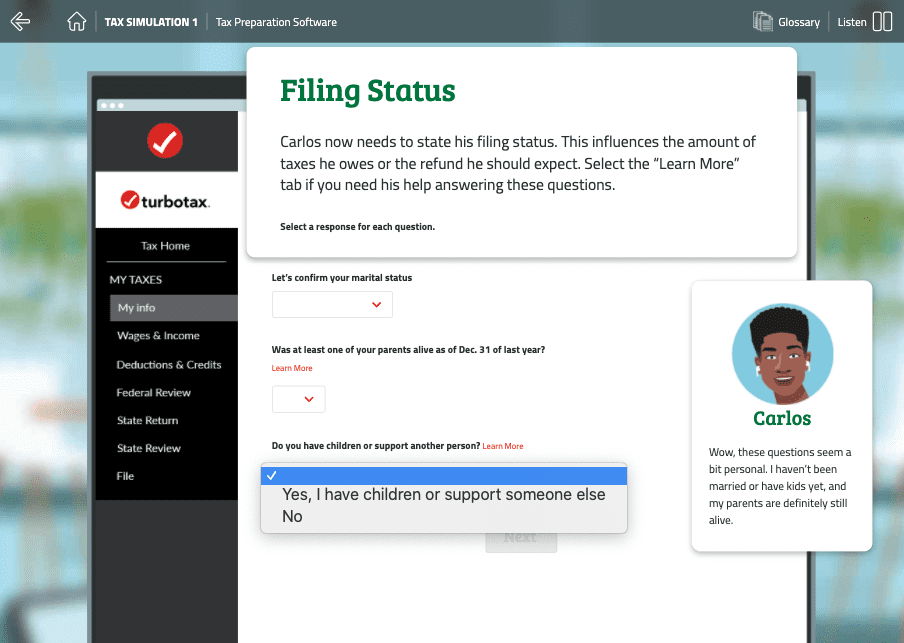

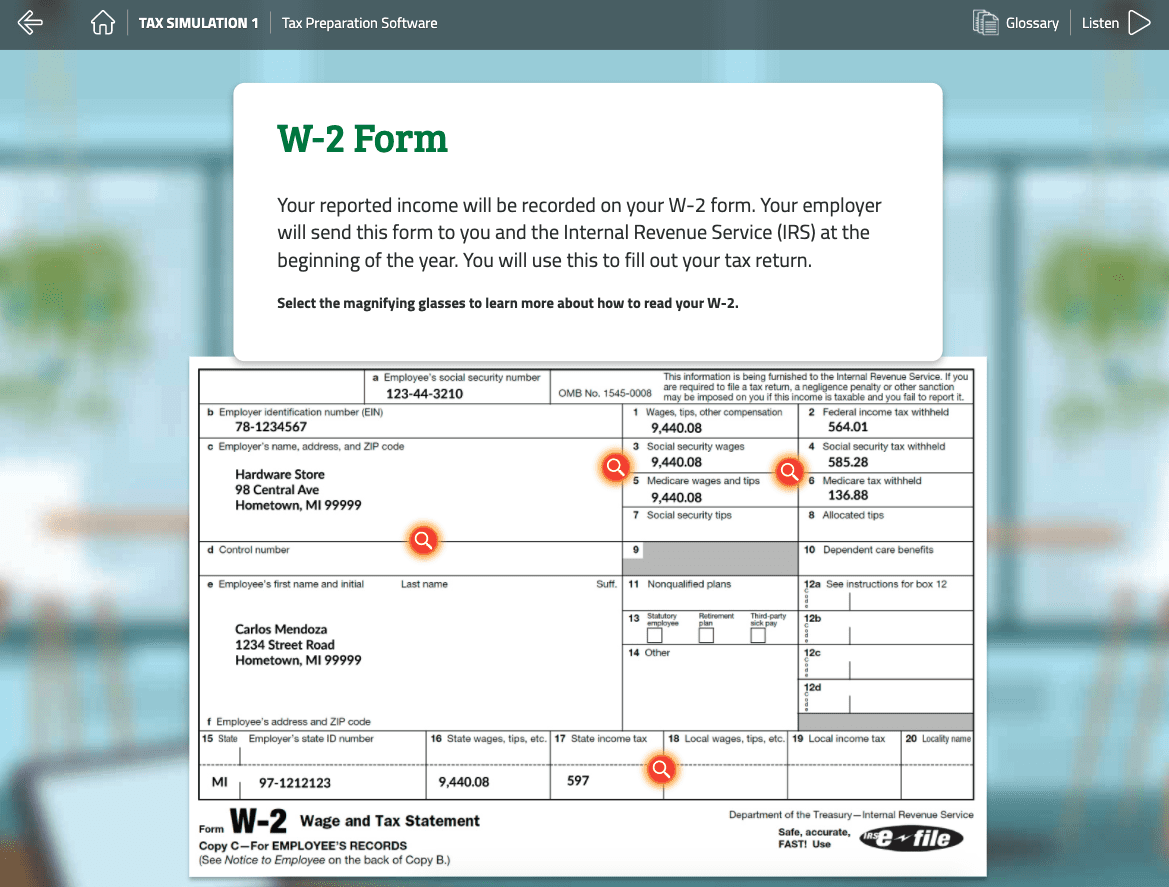

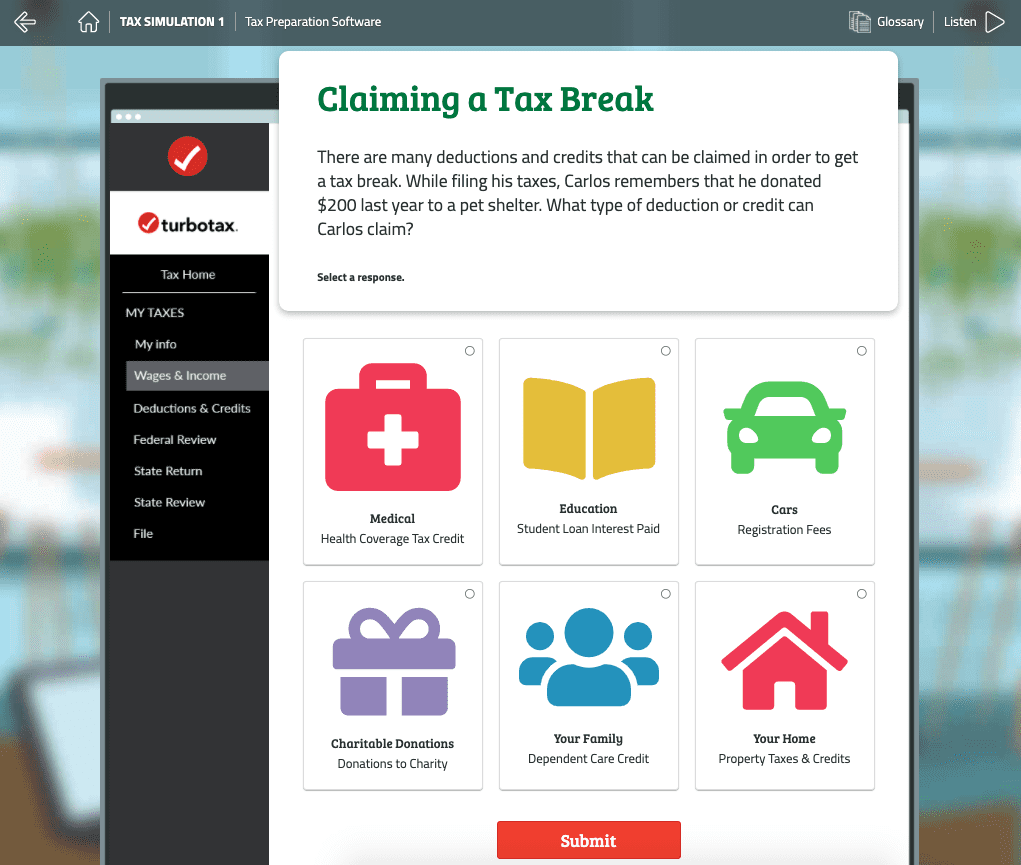

Constructed round tales and interactive workout routines, the Intuit TurboTax Simulation prepares college students to make real-life choices about funds. Beginning with a tutorial on tax fundamentals, college students learn the way taxes are calculated. Then, by situations that includes younger folks identical to them, they work by tax preparation themselves and learn the way totally different life conditions influence taxes. Among the duties they sort out embody find out how to use tax preparation software program, find out how to pay taxes for a gig-economy job, find out how to declare pupil mortgage curiosity and academic bills, and extra.

It takes simply 45 minutes to finish 5 interactive simulations!

The great tax simulations stroll college students by vital abilities to be taught why we file taxes, how totally different life circumstances influence taxes, and the steps required for making ready them.

The 5 simulations embody:

- Submitting Your Taxes

- Tax Credit for Households

- Taxes for Gig Staff

- Taxes for College students

- Taxes for Investments

High quality sources result in high quality studying.

EVERFI’s knack for creating immersive digital environments that includes numerous characters brings private finance matters to life for college students. And like all of EVERFI’s applications, the Intuit TurboTax Simulation was designed with Bloom’s taxonomy framework of studying and evaluation in thoughts. The simulation is aligned with Leap$tart Coalition’s Nationwide Requirements for Ok-12 Private Finance Schooling. As well as, EVERFI programs even have the ISTE Seal and Digital Promise Product Certification, making them useful sources you possibly can rely on.

Construct their confidence for the long run.

Utilizing problem-solving, self-reflection, and interactive actions to apply their abilities, college students will come away with the flexibility and information they should deal with a really grown-up job confidently on their very own. As one highschool instructor from Oklahoma says: “I feel like this was an important and effective lesson for my students to learn about financial literacy. They are all about to get summer jobs and it is really important for them to know where their money will be going in regard to taxes. The taxes were a big surprise to them.”

Curious and need to strive this system your self? Be taught extra concerning the Intuit TurboTax Simulation from EVERFI right here.